Find out more about the movement to bring public banking to Washington by checking out our latest editorials and reports in local news

Editorials and Media Mentions

-

Pacific Time

In this episode of Pacific Time, host Greg Amrofell talks with Marco Rossi, a public banking advocate and legislative strategist with Washingtonians for Public Banking. Together, they explore how state- and city-owned public banks could equip us to address our own challenges and insulate us from the financial shenanigans of Mega Banks and mis-guided politicians.

-

The Cascadia Advocate

The state’s own fiscal woes, which are connected to its perpetually upside down tax code, will continue to make writing budgets difficult. The dilemma for all states is clear: either find new ways to fund essential services or face relentless austerity.

-

The Cascadia Advocate

SB 5754 would create a public bank that would act as a depository institution for Washington. The legislation did not get a "do pass" recommendation from the Ways & Means Committee, but it can be revived in the 2026 legislative session, as odd year bills carry over to even years.

-

Northwest Citizen

Local action in support of a proposal to rebuild nationwide infrastructure

-

Northwest Citizen

Private banks are fighting hard to keep us from starting our own state bank. There’s a reason.

-

The Cascadia Advocate

Musk and Ramaswamy are swamp creatures who want to lay waste to the federal agencies like the Consumer Financial Protection Bureau that are working with great care to protect Americans from greed, graft, and unfairness.

-

Northwest Citizen

Chaos likely to ensue. Catastrophe cannot be ruled out.

-

Northwest Citizen

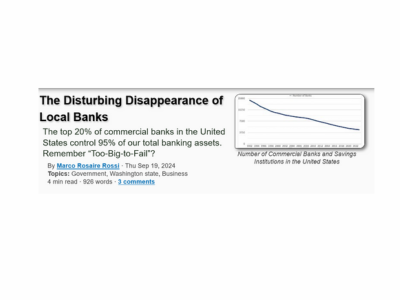

The top 20% of commercial banks in the United States control 95% of our total banking assets. Remember “Too-Big-to-Fail”?

-

Z Magazine

On August 19th, public banking advocates found they have a surprising supporter. Florida’s Chief Financial Officer (CFO), Republican Jimmy Patronis, announced that his office requested that the Florida legislature consider creating a state-owned public bank.

-

The Cascadia Advocate

The report is a reminder that financial behemoths must change their lending practices or have their assets transferred to an institution that can adequately represent the common good if we're to make real progress in combating the climate crisis.

-

The Cascadia Advocate

Depriving states of the means to modestly regulate national banks would further tilt America’s already unfair banking system in favor of megabanks like Bank of America.

-

Real Change

In 1975, the Central Seattle Community Council Federation published a report claiming that the lending practices of Seattle’s banks as related to redlining were “destroying our neighborhoods.”

-

The Cascadia Advocate

After the Great Recession, lawmakers promised that the reforms they instituted secured America’s banking sector. However, as long as the United States sticks to a predominately private banking sector — one that cannot operate counter-cyclically nor dedicate financing to social needs — that promise of long-term security is elusive.

-

The American Banker

A bill that has yet to make it out of the Washington State Senate would establish a public bank with a narrow scope, giving municipalities an alternative option to the bond market for financing a variety of infrastructure projects.

-

Real Change

Washington helped weaken the predatory payday loan industry, but now it is planning a comeback by going after the Consumer Financial Protection Bureau.

-

Seattle City Council

The Seattle City Council passed a resolution urging the federal government to create a National Infrastructure Bank which would help repair the country's aging infrastructure and build modern transit, affordable housing, and so forth.

-

The Vermont Digger

If Vermont is going to survive a future of historic flooding, then historic investments need to be made into the state.

-

The Cascadia Advocate

If Washington is going to deal seriously with the impacts of global warming, including making the necessary investments throughout the state, then it should embrace the promise and potential of public banking.

-

The Stranger

As of recently, the federal government—whether it is extending FDIC insurance, facilitating the sale of troubled banks, or making sure funds are available through the Federal Reserve’s new Bank Term Funding Program—has become quite comfortable interfering in the private banking sector. The only problem is that it is not necessarily to the benefit of average Americans.