Why We Need Public Banking In Washington

In today’s economy, Washington’s residents are struggling. Unless we prepare for our future, Washington will become an unaffordable state that is lacking in essential infrastructure. Fortunately, there is an answer. A public bank of Washington allows the state to make critical investments in the state's economy. Modeled after the Bank of North Dakota, a public bank of Washington would be financed by the revenue from the state. The public bank would then leverage its capital into credit for projects supported by Washingtonians. Not only would this bring needed capital to neglected investments, but—because the bank operates on a nonprofit basis—it would also provide much competition to the private sector banking and act as a financial support system for communities throughout the state.

Find out more by reading the information below. Discover how public banking can benefit the causes of native sovereignty, racial justice, clean energy, public infrastructure, rural communities, housing affordability, and while also helping out Washington's cannabis industry, it local and municipal governments, and its community banks and credit unions.

Why We Need Public Banking In Washington

-

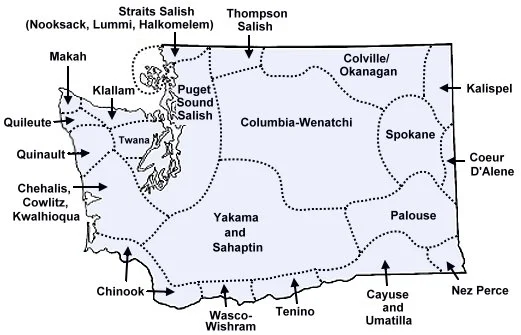

Public Banking and Native Sovereignty

-

Public Banking and Racial Justice

-

Public Banking and Clean Energy

-

Public Banking and the Cannabis Industry

Description goes here -

Public Banking and Public Infrastructure

Description goes here -

Public Banking and Community Banks

Description goes here -

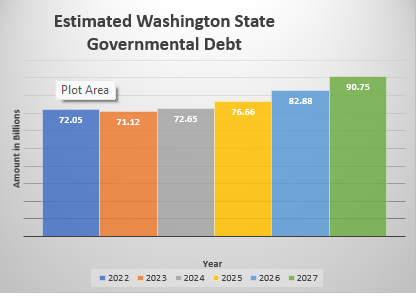

Public Banking and Public Debt

Description goes here -

Public Banking and Housing Affordability

Description goes here -

Public Banking and Rural Communities

Description goes here